Does investing in the stock market gives you chill? Does the old market crash story make you feel vulnerable to the big investors and the bubble you might be trapped in? Well, this is common for everyone who doesn’t know about the stock market.

Many even consider the stock market as a platform to gamble their luck. They help you picture the huge returns by investing in shares but doesn’t show you the downside of it. Well, thanks to the ‘hot tips,’ which has misled thousands of investors.

The stock market is a platform for users to buy a stakeholding in one of their chosen companies. However, the huge amount of trading in this market has led to different concepts, which ruins it all for many. Whatsoever, the swing between fear and greed must be balanced using the right risk and return analysis.

I won’t deny that the stock market doesn’t possess downside risk. But this can be tackled using a disciplined approach, which will be efficient enough to increase the net worth.

While most of us believe in keeping our in fixed deposits and saving account, millionaires and billionaires and increasing their wealth by investing in some of the best stocks in this world.

However, the stock market is a vast concept. There are a lot of materials that make the stock market possible. Let’s dive into the most basic one, i.e., a stock?

What is a Stock?

Stock (also known as shares) is a simple context. It is a financial instrument that allows a person to invest in a company. In other words, the stock of a company will help a person claim his portion of the assets, liabilities and earnings of that company.

Stockholder prefers to divest their investment into different companies to minimize their risk. However, that’s a different story.

Imagine you own 100,000 shares of a company. Now, one might feel that the percentage of holding will be high as well. However, this depends on the total share outstanding in the market. Depending on the assets and liabilities of a company, the total net worth is divided into several shares.

Therefore, the 100,000 shares owned by you might just be a fraction of the total shares available in the market. Similarly, the value of each share affects the holdings of a person. The 100,000 shares owned by you might be just $100,000 if each share has a value of $1. On the other hand, it can carry a value of $1,000,000 if each share has a value of $10, and this goes on.

Well, the stock is also called equity, and it can be classified into two categories – Preferred and Common Stocks.

Both of these shares are tradable in the stock market. However, most of the traders prefer to go with the common stock due to the returns and voting rights it possesses.

There are differences between the two types of stock if we go into the bylaws. However, the most common difference arises during the voting rights and the return generating skills of both.

Preferred shares are considered a safer medium to hold a portion of the company. They don’t have any voting right in the board meetings or the decision making of the company but still be considered an owner of the company. As the name suggests, they are ‘preferred’ to common shares when it comes to providing returns (dividends).

But there is a twist in the story. As this is the safer mode of investment, the returns are limited. The return is being capped by the company, and the owner of these shares won’t get anything more than that.

On the other hand, common shares are vulnerable to losses but have a higher risk-return margin. With this, one can find that the common shares have a voting right in the decisions of the company. Therefore, if you hold a major portion of a company, you have the rights to be included in the board meetings of the same.

The common shares can be further divided into two categories, but that is not the motto of our discussion. But, the question is, why do companies need to issue shares when they are making great returns.

Why Companies issue shares in the stock market?

Well, the answer to it is very simple. Everybody is not fed with a silver spoon. Some have the money while others have the knowledge which they can put together. All the richest people today are those who once believed in their idea and came up with a plan to execute it.

From Mark Zuckerberg to Jack Ma, every entrepreneur had to go to some venture capitalist or hedge fund to generate cash flow. Well, they are not going to hand over their savings to you for nothing.

Therefore, in return, they take a portion of your company or take shares from you. Every dream needs a great mindset to execute it. To scale your business, the need for cash flow will arise at every doorstep. You will have to rent an office, hire employees, put together a distribution network and a 100 different things.

When everything is brought together, the expenses rise to a different level. Therefore, by selling off the shares of the company, they manage to generate/raise capital.

Well, there are different ways one can raise capital, and it doesn’t need to be by selling off the shares themselves. They can go to a bank or a deb provider, or some other firm that is ready to help them at a cost (return).

However, the initial stage of raising capital can’t be from the stock market. There are strict norms that a company has to go through in order to register itself as a public company.

Every country has its own stock market, and with that, they have their own rules. Being listed on a stock exchange is the ultimate level that a company can achieve to raise capital. Well, this is possible by Initial Public Offerings.

Initial Public Offerings

When the company feels that they can’t raise capital via debt anymore and exhausting their shares is the best decision, the board members take the company to a different level by listing it on the stock exchange. The process of listing the company’s share on the exchange for the first time is known as Initial Public Offering or IPOs.

With this, the status of the company is changed to a public traded company as they are being held by retail investors as well. While the company was owned by a limited number of people, now, everybody can participate to gain a portion of the same.

During the listing of the share, everything detail regarding the financials of the company is disclosed along with the actual price of the shares.

Once the listing is completed, the investors are free to trade on the share. Depending on the market sentiments, the price of the share will fluctuate as they will be deciding the price for it. If they find the listed price to be overvalued, they will not invest or start selling the share, which will drop the price of the share.

On the other hand, if they find it to be undervalued, the investment in this share will rise, which will account for the rise in the price of the share.

However, these stocks are not directly listed on the stock market. They are first traded in the primary market where the price is being decided by the institutional investors or the big investors.

With this, we all are acquainted with the concept of shares and how it can trade. Let’s know more about what a stock exchange is and how it works?

What is Stock Market?

The stock market or the stock exchange is the secondary market where the existing shareholders trade their share with the person looking to buy it. Most of us misunderstand that it is the company that sells and buys the shares on the stock market it is listed.

However, this concept is wrong. The company sells it to the promotors who deal with the shares in the market. The company can only engage in issuing new shares and buybacks. Well, these won’t be a day-to-day business. Therefore, always remember that you are not buying the share directly from the company. Rather it is some other person who had it for the first time.

Stock exchanges have had a rough time. Every developing country has to face several accusations from the public whenever they lose money in some emerging companies. Well, it is the duty of the regulatory body to maintain the laws properly. However, we as an investor must be aware of the financial condition of a company before investing in the same.

Apart from it, we must be thorough about the management and the way they operate. You won’t want to invest in a company that is operated by some fraud.

Stock Market History

The stock market has evolved over time. The freedom to invest that we have today was limited by the technology available years ago. With everything on paper, the trading volume was limited as only the sophisticated people knew about it.

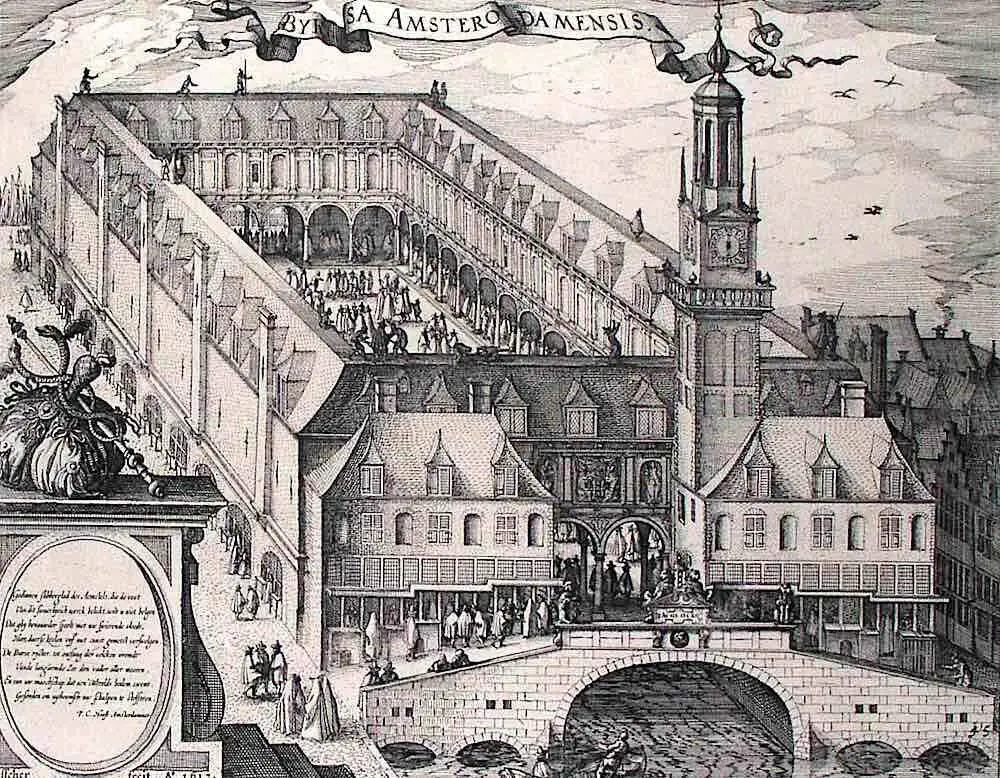

The first stock exchange was set in Europe and is known as the Amsterdam Stock Exchange. It was back in the 17th century when this stock exchange started. However, the companies traded here were not allowed to issue equities; rather, the concept of equities was not thought of back then.

They used to trade the bonds which worked right for them.

In the later 18th century, the New York Stock Exchange or NYSE showed the real potential of the equity shares. The NYSE was started in 1792 after the Buttonwood Agreement. With the introduction of the NYSE, a sense of professionalism and regulation took a toll on the methods of trading.

However, the market was not as liquid as it is today. The trading volume was still limited. Most of the trades were made over-the-counter, i.e., in person. This has changed drastically with the advancement in technology. Individuals don’t have to walk to some office to buy shares anymore.

They can do it using their cell phone or desktop by login into the brokers, which helps the user to trade.

How Does Stock Market Works?

As mentioned earlier, the stock market is the secondary market. All the price to be offered in the stock market is already being decided by the players in the primary market.

The price is set using an auction between the sellers and the buyers. Once the price has been selected, the public gets to apply for the same via the IPO offerings.

However, if a share is oversubscribed, it becomes hard for the retail investors to get a portion of it and thus, they have to wait for it to come to the stock exchange and buy it at the overpriced rate.

While on the stock exchange, you can understand how the price of a share fluctuates if you get an idea about the bid and ask the price of that share.

For a share to trade, the presence of two parties are always essential, i.e., a buyer and a seller. When there is a clash of the bid and ask price, the transaction is completed. The bid price is the offered price at which the buyer is ready to acquire the share, while the asking price is the rate at which the seller is ready to sell.

One transaction is a very small fragment of what comprises the stock market. There are millions of investors and traders who complete the stock market. When a huge amount of investment is seen in one share, the price starts to fluctuate rapidly.

However, this price fluctuation is very short-termed as the price is meant to return to its intrinsic value depending on the financials of the company.

This is how the price is being decided for a share. Investors must always follow either the technical or the fundamental analysis to come up with a strategy. Technical analysis helps the traders invest in the shares for a short period, while fundamental analysis is required for long term investments.

In simple words, technical analysis is the study of stock market graphs, and fundamental analysis is the study of the financial statements of a company like the balance sheet, cash flow statement and income statement.

Whatsoever, that’s a different chapter.

Let’s know more about the different kinds of investors that we find in a stock market.

Types of Investor in Stock Market

If we start to classify the different types of investors in the market, then the list might go on. Therefore, we will stick with the top classification, which will help us understand the players in the market.

This is a crucial factor as it helps us decide who the person we will be dealing with?

#1 Foreign Institutional Investors (FII)

Every stock exchange has a great portion dominated by foreign institutional investors. With a huge amount of money being invested in the NYSE, a large portion is being captured by this FII. This kind of investor is everybody from a different geographical location who believes in the economy of that country.

Government and the stock regulation body has a huge say on the type of investment that will be coming in. During the pandemic, the Indian government banned the investment policies by China into BSE and NSE.

To avoid any political or corporate takeover in the country, governments have to intervene in the same.

#2 Qualified Institutional Investors (QII)

These are the backbones of any stock exchange. All the pension funds, hedge funds, mutual funds and the different organization which holds a huge sum of money gathered from the public finds a way to invest in the stock market. With this huge control, they can easily drive the price of a stock up and down.

Therefore, as an individual investor, you can use their tactics to earn some long-term returns. If they come up with a positive report for a company, then there will be huge fluctuation in the share price in the upcoming sessions.

#3 Retail Investors

The last set of investors who suffers the most in the market are the retail investors. The number of retail investors is usually low in the market as they believe in handing out their money to someone who has better knowledge in the field.

However, many of the individual investors believe in different information anomalies and take the wrong step. This is why they end up losing a huge sum of money.

We need to understand that investment in the stock market is not an easy task; there are several individuals who spend years learning the formula to find the right stock for their profits. Because it is your hard earn money which you will be investing in the company.

Therefore, always take a sharp look at the company’s finances before investing in the same.

Well, if you are planning to invest in the stock market, you must be aware of the different types of investment tactics that you can implement in the future. This will help you out with the right decision making policy.

Types of Investments

#1 Intraday or Day Trading

Intra Day or Day Trading has been highly used by traders to gain profit in a short span. The duration of investment is really short as the deal has to be closed on the same day.

It is considered to be highly speculative as everything is based on the stock market chats, and there is a huge potential of downside risk. Therefore, retail investors should avoid this if they don’t have proper knowledge about the same.

#2 Swing Trading

Swing trading is one of the safest modes of investment in stocks. Whenever we talk about short term investment, picking up swing trading will sound just right. The investment is pretty safe as you invest in the share for a week or two. It can even last for a month.

This way, you can make sure that all the short-term fluctuation in the price of the share is taken care of properly. In other words, you make sure that the short-term fluctuation doesn’t affect your investment pattern.

#3 Long Term Investment

We all have heard about how people have grown their wealth by investing in companies for years. All the presentations on different stock market charts about the stock pricing rising from $5 to $241 and multiplying the investment by thousand times are actually possible.

One of the greatest investments made by Warren Buffet was in Coca-Cola Corporation. With his small investment in the company, he makes $2 million in dividends every day. Well, long-term investments do pay off, but the capability to bear certain losses must be high.

If you have valued stock for its financial statements and the great management it has, then there is no way that the stock won’t get back to your target price in the future.

There are thousands of options in the market, and you need to pick up the right one for you.

#4 Derivatives

Derivatives are a financial instrument that helps the investor to leverage time and gain good profit over their total investment. This is like a bet against the price of a stock going up or down.

The underlying asset here can be anything like the different indices in the market or even a tradable commodity like gold. The benefit of investing in derivatives is that you don’t have to provide the total price of the underlying asset; rather, you provide a section of it to ensure your credibility.

Imagine you bet on a stock price rising by the end of the month. Now, the strike price or the price at which you bet is $100. There might be fluctuation in the price of the stock, but the price at the closing date of the deal is what matters.

If the closing deal is after a month and the price is $110, then you will be receiving $10 by the party you bet with. This is how a derivative works.

However, the structure is really complex, and there are a lot of terminologies that are involved in it. There are extensive courses available that help a user understand the policies better.

#5 Mutual Funds

We all know that the economy is run by heavy investments in different industries. If there isn’t any synergy, then it is difficult for the economy to grow—one of the best ways to ensure the regular flow of investment in mutual funds.

Mutual funds are the qualified institutional investors who look after the needs of the investors, along with meeting the economic goals of the country. QIIs have the responsibility to invest in different companies and, thus, help the investors grow their fund.

Any person who doesn’t want to invest in a fixed deposit and is looking out for a good return can invest their money in mutual funds. This way, they won’t have to worry about the different investment plans and, thus, can take care of other things.

Conclusion

With that, all the different aspects of the stock market have been covered. Before entering the market, be aware of the stock market timing and the different news that will be driving the market today.

As an investor, you must always be ready to face certain changes in the market as you will be vulnerable to raiders who drive the market.

Find the right type of investment for your strategy and go with it for the long-term. No Castle is built in a fortnight!